san antonio property tax rate 2020

What is the property tax rate in San Antonio Texas. Property Tax Rate The property tax rate for the City of San Antonio consists of two components.

Tac School Property Taxes By County

2019 Official Tax Rates Exemptions.

. Property Tax Rate Calculation Worksheets Senate Bill 2 SB2 of the 86 th Texas Legislature requires the Tax Assessor-Collector from each county to post their website the worksheets used to calculate the No-New-Revenue and Voter-Approval tax rates for the most recent five 5 years. The voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. News at 9 9 in depth Property taxes San Antonio Housing Real Estate Texas Legislature KSAT Explains KSAT News at 9 gives you a deep dive into rising property taxes and how it affects you.

Ad Search County Records in Your State to Find the Property Tax on Any Address. In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The rates are given per 100 of property value.

The tax rate is the same as the 2019-2020 fiscal year though the County estimates it will. 34677 cents per 100 The property tax rate for the City of San Antonio consists of two components. City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office.

Physical Address 100 W. 2020 Official Tax Rates Exemptions. San Antonio TX 78207.

For questions regarding your tax statement contact the Bexar County Tax. The tax rate varies from year to year depending on the countys needs. Should the current public health situation considered a disaster.

The no-new-revenue tax rate is the tax rate for the 2020 tax year that will raise the same amount of property tax revenue for ALAMO COMMUNITY COLLEGE DISTRICT from the same properties in both the 2019 tax year and the 2020 Tax Year. Southside - 3505 Pleasanton Rd. Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday.

Scott Ball San Antonio Report. Notice of Effective Tax Rate Author. Box 839950 San Antonio TX 78283.

Northeast - 3370 Nacogdoches Rd. Monday-Friday 800 am - 445 pm. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

What is San Antonio property tax. Table of property tax rate information in Bexar County. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261.

The median property tax on a 11710000 house is 248252 in Bexar County. Northwest - 8407 Bandera Rd. 2020 Official Tax Rates.

Historical Property Tax Rate. China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest rate in the area. Maintenance Operations MO and Debt Service.

Realtytrac Releases Its Rental Forecast For 2016 San Antonio Business Journal Home Refinance Local Real Estate Real Estate. San Antonio TX 78207. 8132020 15945 PM.

County Manager David Smith has presented the proposed budget for FY 2020-21 and is once again proposing to maintain the current tax rate of 0301097. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

Tax Rate 100. VOTER-APPROVAL TAX RATE. The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns.

The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8. Maintenance Operations MO and Debt Service. Michael Amezquita chief appraiser for the Bexar County Appraisal District.

2019 Official Tax Rates. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. The Commissioners Court also voted Tuesday to approve the proposed tax rate of 0301097 per 100 of valuation.

Monday-Friday 800 am - 445 pm. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The no-new-revenue tax rate would Impose the same.

48 rows San Antonio. San Antonio TX 78205 Phone. What could this new law mean for San Antonio-area property owners in 2020.

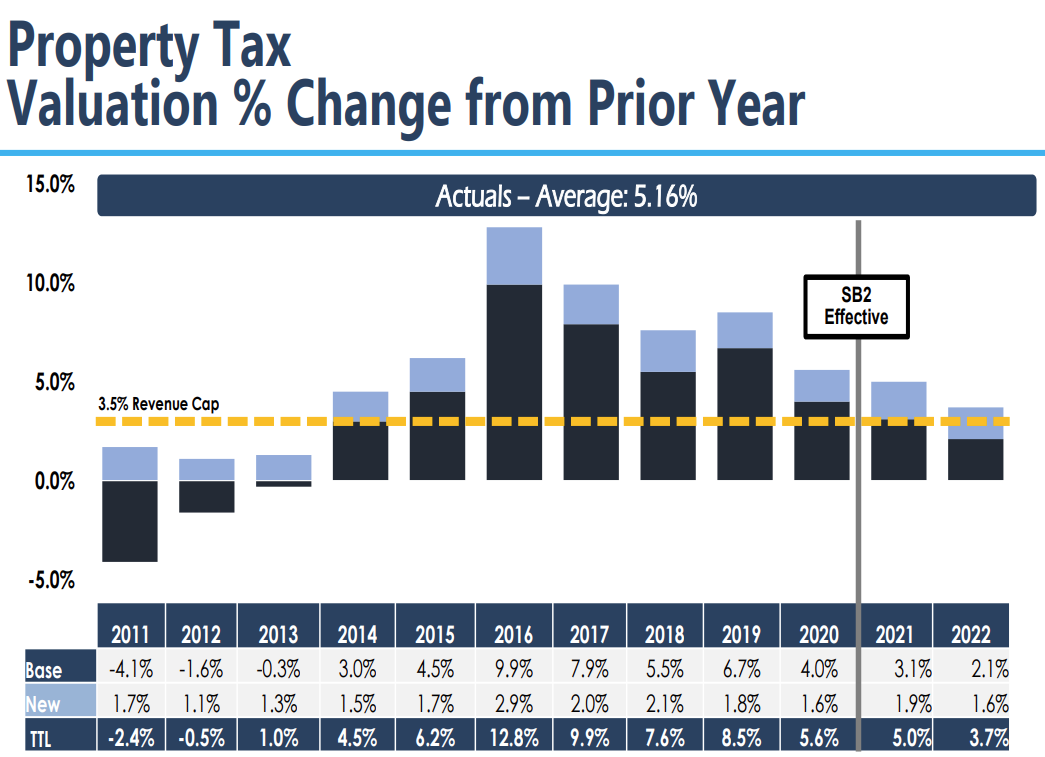

New Rollback Rate of 35 starting in FY 2021 Existing MO Property Taxes cannot grow by more than 35 without an election City will forego 7 Million in base General Fund revenue due to SB 1152 - Cable Telecom Bill starting in FY 2020. 2019 Official Tax Rates Exemptions. This years no-new-revenue tax rate.

65 rows 2020 Official Tax Rates Exemptions. Public Sale of Property PDF. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

2020 Official Tax Rates Exemptions. This notice concerns the property tax rates for This notice provides information about two tax rates used in adopting the current tax years tax rate. San Antonio TX 78205.

Box 839950 San Antonio TX 78283. Truth in Taxation Summary PDF.

Tax Rates Bexar County Tx Official Website

Tac School Property Taxes By County

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Bexar County Commissioners Approve Symbolic Property Tax Cut

How To Protest Your Texas Property Taxes Win Home Tax Solutions

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Which Texas Mega City Has Adopted The Highest Property Tax Rate